Self-employment can be a rewarding way to earn a living, but it also comes with its own set of challenges. One of the key considerations for self-employed individuals is calculating their self-employment tax and deductions accurately. This ensures that they are compliant with tax laws and maximize their tax savings. As we enter the year 2024, it’s important for self-employed individuals to familiarize themselves with the latest tax laws and guidelines.

Self-employment tax is a tax that self-employed individuals must pay to fund Social Security and Medicare. It is calculated based on your net earnings from self-employment. The self-employment tax rate for 2024 is 15.3%, which is divided between the Social Security tax rate of 12.4% and the Medicare tax rate of 2.9%. Self-employed individuals can deduct half of their self-employment tax when calculating their adjusted gross income.

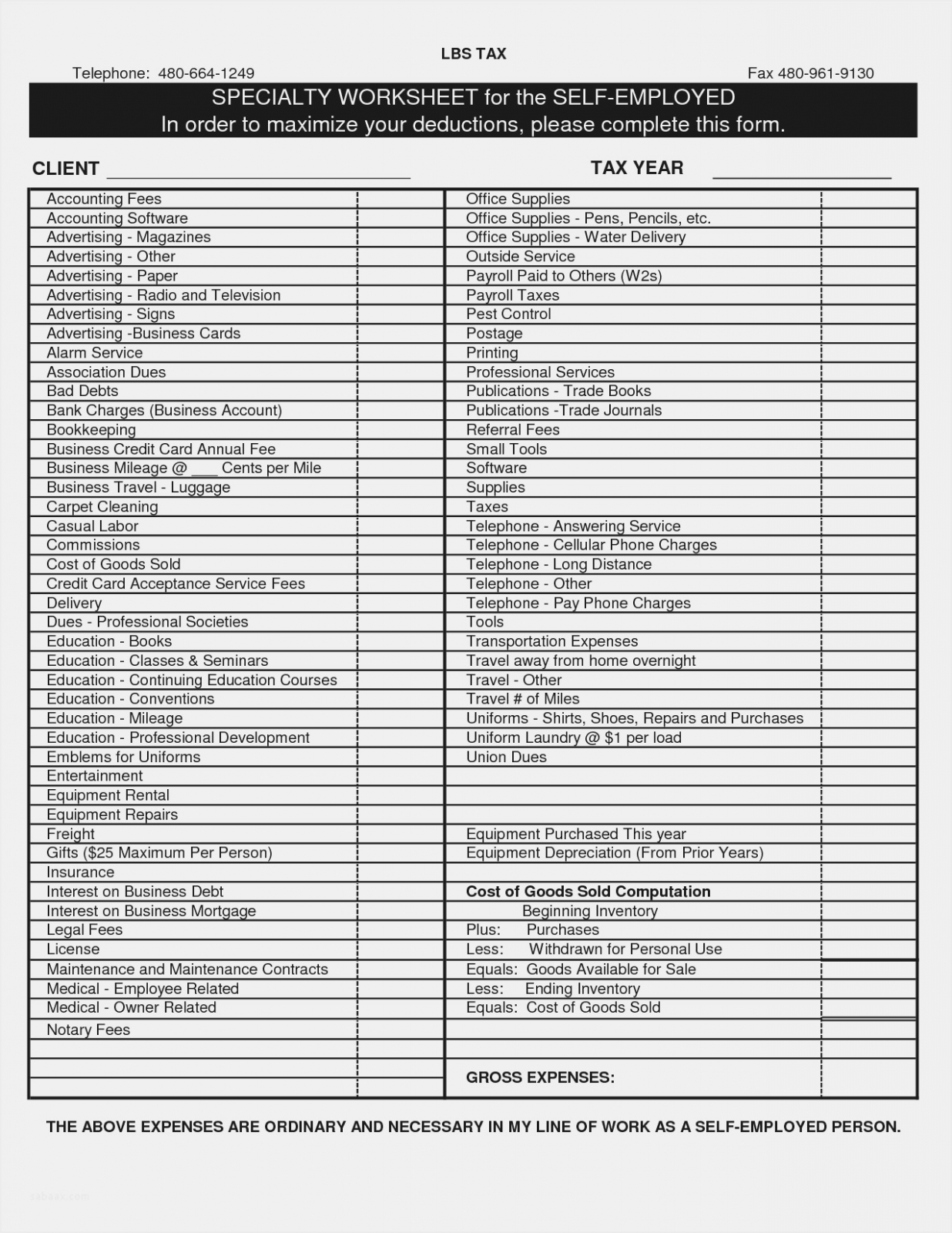

When it comes to deductions, self-employed individuals have the opportunity to deduct a variety of business expenses to reduce their taxable income. Common deductible expenses include office supplies, marketing costs, travel expenses, and health insurance premiums. Keeping detailed records of these expenses throughout the year can help you maximize your deductions and lower your tax liability.

It’s important for self-employed individuals to accurately complete the self-employment tax and deduction worksheet to ensure that they are taking advantage of all available deductions and credits. This worksheet helps you calculate your self-employment tax liability and determine your allowable deductions. By carefully filling out this worksheet, you can avoid costly mistakes and potentially save money on your taxes.

As you prepare for the tax year 2024, it’s a good idea to consult with a tax professional or accountant to ensure that you are maximizing your tax savings and staying compliant with the latest tax laws. They can provide guidance on which deductions you qualify for and help you navigate the complexities of self-employment tax. By staying informed and proactive, you can set yourself up for financial success as a self-employed individual in 2024.

In conclusion, understanding the 2024 self-employment tax and deduction worksheet is essential for self-employed individuals to accurately calculate their tax liability and maximize their deductions. By staying informed, keeping detailed records, and seeking professional guidance, you can navigate the complexities of self-employment tax with confidence and ensure that you are making the most of your tax situation.