Creating a budget worksheet is an essential step in managing your finances effectively. It helps you track your income and expenses, identify areas where you can cut costs, and stay on top of your financial goals. By having a clear overview of your finances, you can make informed decisions about your spending and saving habits.

Whether you are looking to save for a big purchase, pay off debt, or simply want to have a better handle on your finances, a budget worksheet can be a valuable tool. It allows you to see where your money is going each month and make adjustments as needed to reach your financial objectives.

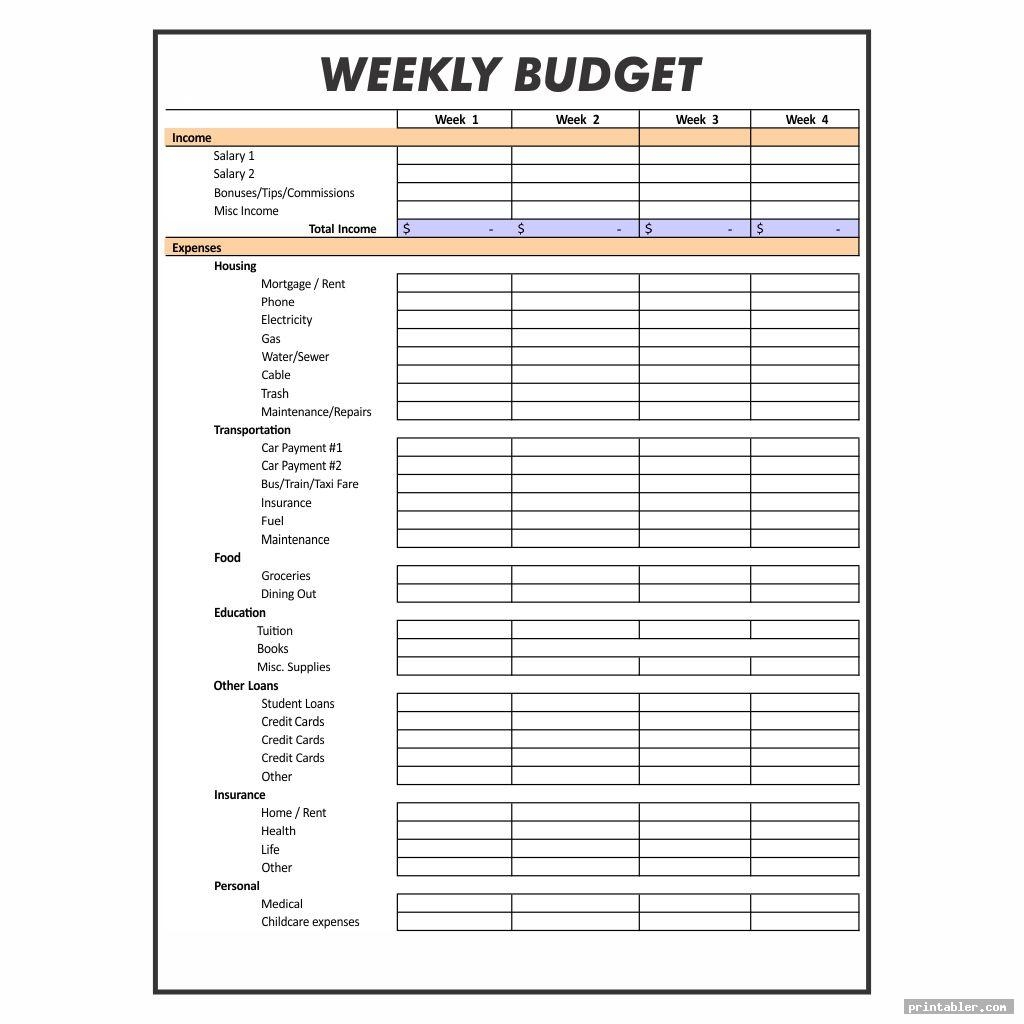

Budget Worksheet Example

Here is an example of a simple budget worksheet that you can use to get started:

| Category | Amount |

|---|---|

| Income | $XXXX |

| Housing | $XXXX |

| Utilities | $XXXX |

| Transportation | $XXXX |

| Food | $XXXX |

| Entertainment | $XXXX |

| Savings | $XXXX |

Start by listing all your sources of income at the top and then categorize your expenses below. Make sure to include all your fixed expenses like rent, utilities, and transportation, as well as variable expenses like food and entertainment. Allocate a portion of your income to savings to build an emergency fund or work towards your financial goals.

Once you have filled in all the amounts, calculate your total income and total expenses to see if you are spending within your means. If you find that you are overspending in certain categories, look for areas where you can cut back to balance your budget.

Regularly update your budget worksheet each month to track your progress and make adjustments as needed. Over time, you will develop better financial habits and be more in control of your money.

In conclusion, a budget worksheet is a valuable tool for managing your finances and reaching your financial goals. By creating a detailed budget, you can make informed decisions about your spending and saving habits and work towards a more secure financial future.