Capital gains tax is a tax imposed on the profit made from selling an asset that has increased in value. The tax rate can vary depending on the type of asset and how long it was held before being sold. To calculate the capital gain tax owed, individuals can use a capital gain tax worksheet.

A capital gain tax worksheet is a tool used to help individuals determine the amount of tax they owe on the capital gains they have earned. It typically includes information on the purchase price, sale price, and holding period of the asset being sold. By filling out this worksheet, individuals can calculate their capital gain and the corresponding tax liability.

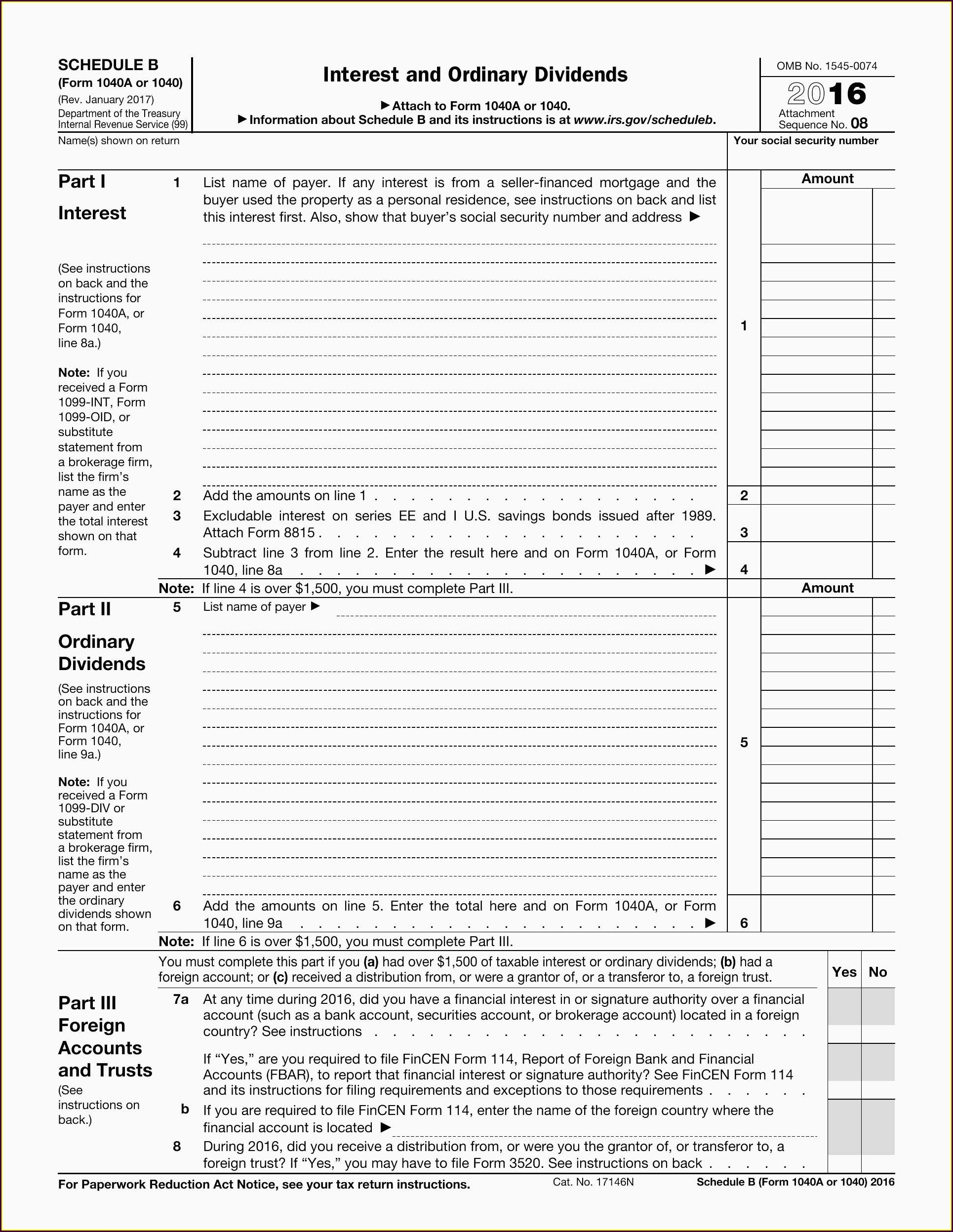

Capital Gain Tax Worksheet

The worksheet will typically ask for details such as the original purchase price of the asset, any additional costs incurred during the holding period, and the selling price. By subtracting the purchase price and costs from the selling price, individuals can calculate the capital gain. The tax rate applied to this gain will depend on the holding period of the asset.

Short-term capital gains, which are assets held for less than a year, are typically taxed at a higher rate than long-term capital gains, which are assets held for more than a year. By using the capital gain tax worksheet, individuals can determine the tax rate applicable to their capital gain and calculate the total tax owed.

It is important to accurately fill out the worksheet and report the capital gains on your tax return to avoid any penalties or audits from the IRS. Keeping detailed records of the purchase and sale of assets can help make the process of filling out the worksheet easier and more accurate.

By understanding how to use a capital gain tax worksheet, individuals can better manage their tax liabilities and ensure compliance with tax laws. Consulting with a tax professional can also provide additional guidance and assistance in navigating the complexities of capital gains tax calculations.

In conclusion, a capital gain tax worksheet is a valuable tool for individuals looking to calculate and report their capital gains tax liability accurately. By providing essential information on the purchase and sale of assets, this worksheet helps individuals determine the tax owed on their capital gains and stay compliant with tax regulations.