Calculating overtime pay can be a daunting task for many employees and employers alike. Overtime pay is additional compensation given to employees who work more than their regular hours in a workweek. It is important for both parties to understand how overtime pay is calculated to ensure fair compensation and compliance with labor laws.

One way to calculate overtime pay is through the use of a worksheet. A worksheet is a helpful tool that breaks down the hours worked by an employee, identifies regular hours and overtime hours, and calculates the appropriate overtime pay. By using a worksheet, employers can accurately determine how much overtime pay is owed to their employees.

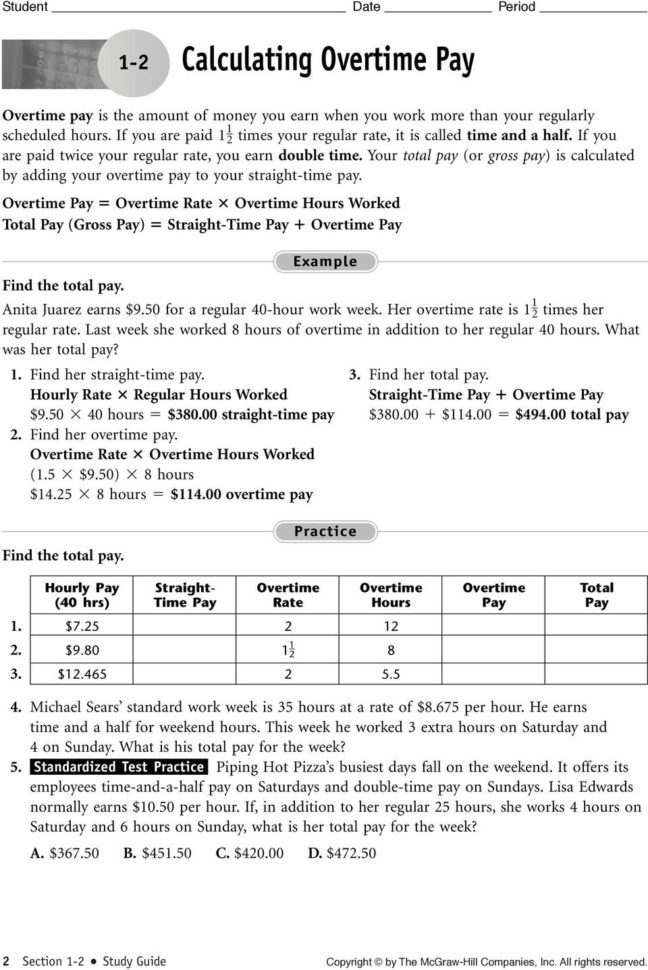

When creating a worksheet to calculate overtime pay, it is important to include the following information: the total number of hours worked by the employee in a workweek, the regular rate of pay, and the overtime rate of pay. To calculate overtime pay, multiply the overtime hours worked by 1.5 times the regular rate of pay. For example, if an employee works 45 hours in a week and their regular rate of pay is $15 per hour, the overtime pay would be calculated as follows: 5 hours x $15 x 1.5 = $112.50.

It is important to note that some states have specific labor laws regarding overtime pay, such as different overtime rates for certain industries or limits on the number of hours that can be worked in a day before overtime pay is required. Employers should be familiar with these laws and ensure that their calculations are in compliance with state regulations to avoid potential legal issues.

Overall, using a worksheet to calculate overtime pay can help both employers and employees ensure that fair compensation is provided for any hours worked beyond the regular workweek. By following the proper calculations and staying informed about labor laws, employers can avoid potential disputes and maintain a positive working relationship with their employees.

In conclusion, calculating overtime pay using a worksheet is an effective way to ensure accurate compensation for employees who work additional hours. By following the guidelines provided and staying informed about labor laws, employers can calculate overtime pay correctly and avoid potential legal issues. Using a worksheet can help streamline the process and provide a clear breakdown of how overtime pay is determined.