As we approach the year 2023, it is essential to understand the concept of capital gains and how they are calculated. Capital gains refer to the profit made from selling assets such as stocks, real estate, or other investments. The Internal Revenue Service (IRS) requires taxpayers to report their capital gains on their tax returns, and using a capital gains worksheet can help simplify this process.

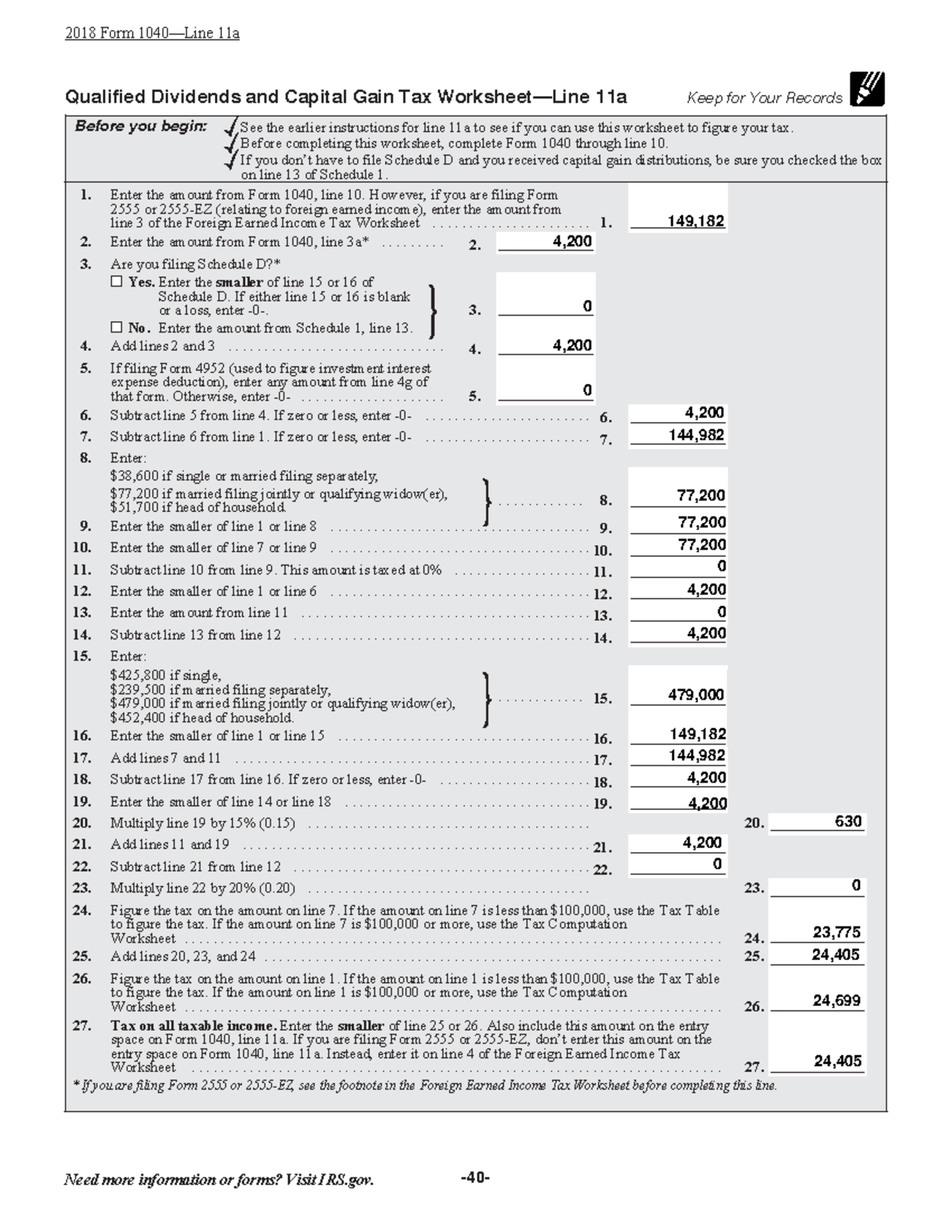

The capital gains worksheet for 2023 will provide a structured format for taxpayers to calculate their capital gains and determine the amount of tax owed on these gains. This worksheet will include information such as the purchase price of the asset, the sale price, and any associated expenses or deductions. By following this worksheet, taxpayers can ensure they are accurately reporting their capital gains and avoiding any potential penalties or audits from the IRS.

When completing the capital gains worksheet for 2023, it is important to gather all relevant financial documents, such as brokerage statements, receipts for expenses, and any other documentation related to the sale of the asset. This information will help ensure that the calculations are accurate and that the taxpayer is taking advantage of any available deductions or credits.

Additionally, taxpayers should be aware of any changes to the tax laws that may impact their capital gains for the year 2023. Staying informed about these changes can help taxpayers make strategic decisions about when to sell assets and how to minimize their tax liability. Consulting with a tax professional or financial advisor can also provide valuable guidance when completing the capital gains worksheet.

In conclusion, the capital gains worksheet for 2023 is a valuable tool for taxpayers to accurately report their capital gains and fulfill their tax obligations. By understanding how to use this worksheet effectively and staying informed about any relevant tax laws, taxpayers can ensure they are in compliance with the IRS and maximize their financial outcomes. Taking the time to complete the capital gains worksheet properly can lead to a smoother tax filing process and potentially save taxpayers money in the long run.