When it comes to investing in the stock market or other assets, it’s important to understand the concept of capital gains and losses. Capital losses occur when you sell an investment for less than you paid for it. These losses can be used to offset capital gains, reducing the amount of tax you owe. However, if your capital losses exceed your capital gains in a given year, you may be able to carry forward the excess losses to future years.

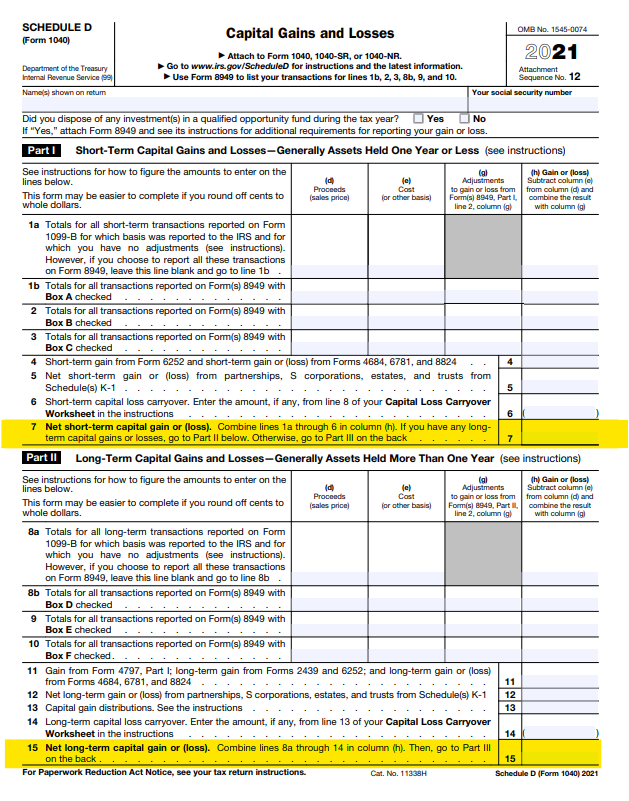

A capital loss carry forward worksheet is a tool used to keep track of your capital losses that can be carried forward to future years. This worksheet typically includes information about the amount of capital losses incurred in a given year, any capital gains offset by those losses, and the remaining balance of losses that can be carried forward.

When completing a capital loss carry forward worksheet, it’s important to accurately report the details of each investment transaction, including the purchase price, sale price, and any fees or expenses incurred. This information will help you determine the amount of capital losses that can be carried forward to offset future gains.

By utilizing a capital loss carry forward worksheet, investors can strategically plan their tax liabilities and maximize the benefits of their investment losses. By carrying forward losses to future years, investors can potentially offset future gains and minimize their tax obligations.

It’s important to note that there are specific rules and limitations surrounding the use of capital loss carry forwards, so it’s recommended to consult with a tax professional or financial advisor for guidance on how to properly utilize this strategy.

In conclusion, a capital loss carry forward worksheet is a valuable tool for investors looking to minimize their tax liabilities and maximize the benefits of their investment losses. By accurately tracking and reporting capital losses, investors can strategically plan their tax obligations and potentially offset future gains. Utilizing this strategy can help investors make the most of their investment portfolios and navigate the complexities of the tax code.