When it comes to managing your finances, organizing your data in a clear and structured manner is key. One common way to keep track of your car loan information is by using a worksheet in a spreadsheet program like Microsoft Excel. However, you may find yourself needing to transfer this data to a new workbook for various reasons. Luckily, this process can be done easily with just a few simple steps.

To begin, open both the original workbook containing the car loan worksheet and a new workbook where you want to copy the data. In the original workbook, right-click on the worksheet tab containing the car loan information and select “Move or Copy.” A dialog box will appear, allowing you to choose the new workbook as the destination. Make sure to check the box that says “Create a copy” before clicking “OK.”

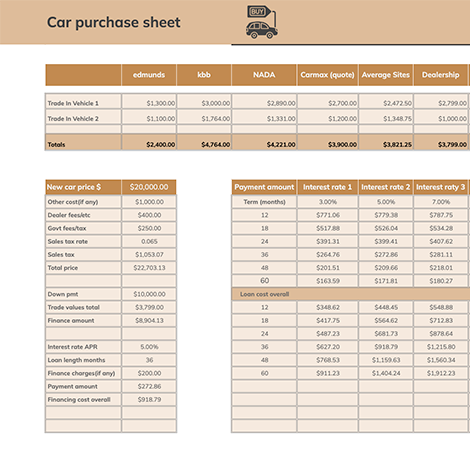

Once you have copied the worksheet to the new workbook, you may need to adjust the formatting or make any necessary changes to the data. This is the perfect time to review and update any information related to your car loan, such as interest rates, payment schedules, or outstanding balances. Take this opportunity to ensure that your records are accurate and up to date.

After making any necessary changes, save the new workbook with a descriptive file name that reflects its contents. This will make it easier for you to locate the file in the future and distinguish it from other workbooks you may have. Consider creating a folder specifically for your financial records to keep everything organized and easily accessible.

With the car loan information successfully copied to a new workbook, you now have a clean and updated record of your financial data. This streamlined approach to managing your finances can help you stay on top of your payments and make informed decisions about your car loan. By following these simple steps, you can easily transfer your data from one workbook to another with minimal hassle.

In conclusion, copying the car loan worksheet to a new workbook is a straightforward process that can help you maintain organized and accurate financial records. By following the steps outlined above, you can ensure that your data is easily accessible and up to date whenever you need it. Take advantage of spreadsheet programs’ flexibility to manage your finances effectively and make informed decisions about your car loan.