As we enter the new tax year of 2024, it is important for individuals and businesses alike to start preparing for their tax obligations. The tax landscape is constantly changing, and it is crucial to stay up to date with the latest regulations and requirements to ensure compliance and avoid any penalties.

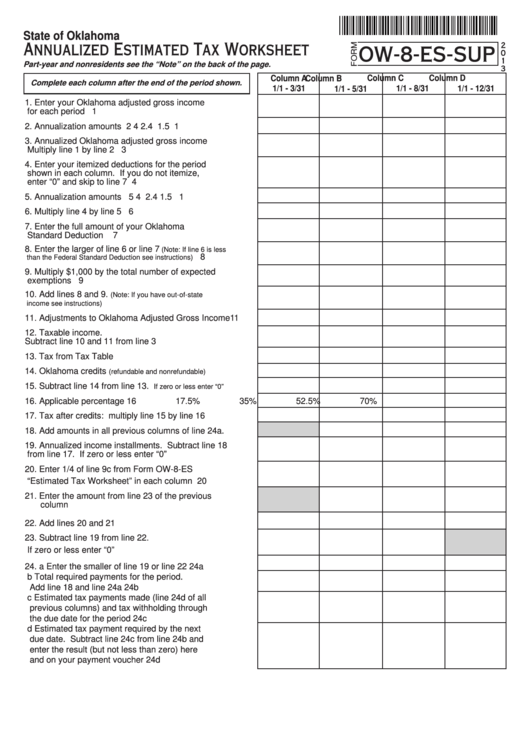

One of the key tools in tax preparation is the tax worksheet, which helps individuals and businesses organize their financial information and calculate their tax liability. By using a tax worksheet, taxpayers can ensure that they are taking advantage of all available deductions and credits, and accurately report their income to the tax authorities.

Tax Worksheet 2024

The tax worksheet for 2024 will include important information such as income sources, deductions, credits, and tax rates. Individuals will need to gather documents such as W-2 forms, 1099s, and receipts for deductible expenses to complete the worksheet accurately. Businesses will need to compile financial statements, profit and loss statements, and other relevant documents to calculate their tax liability.

When filling out the tax worksheet, it is important to pay attention to details and ensure that all information is entered correctly. Mistakes or omissions can lead to errors in tax calculations and potentially trigger an audit by the tax authorities. By double-checking all entries and seeking professional help if needed, taxpayers can avoid costly mistakes and ensure compliance with tax laws.

In addition to the tax worksheet, taxpayers may also need to consider changes in tax laws and regulations that could impact their tax liability for 2024. It is advisable to stay informed about any new developments in tax legislation and consult with a tax professional to understand how these changes may affect your tax situation. By planning ahead and staying proactive, taxpayers can minimize their tax burden and take advantage of available tax-saving opportunities.

In conclusion, the tax worksheet for 2024 is a valuable tool for individuals and businesses to organize their financial information and calculate their tax liability accurately. By using the worksheet and staying informed about tax laws and regulations, taxpayers can ensure compliance with tax authorities and minimize their tax burden. Start preparing for your taxes early and make use of the tax worksheet to stay on top of your tax obligations in 2024.