In today’s consumer-driven society, it can be easy to confuse wants with needs. Many people often find themselves spending money on things they desire rather than things they truly require. This can lead to financial instability and dissatisfaction in the long run.

It is essential to differentiate between wants and needs to make informed decisions about how we allocate our resources. By understanding the difference between the two, we can prioritize our spending and focus on fulfilling our essential requirements first.

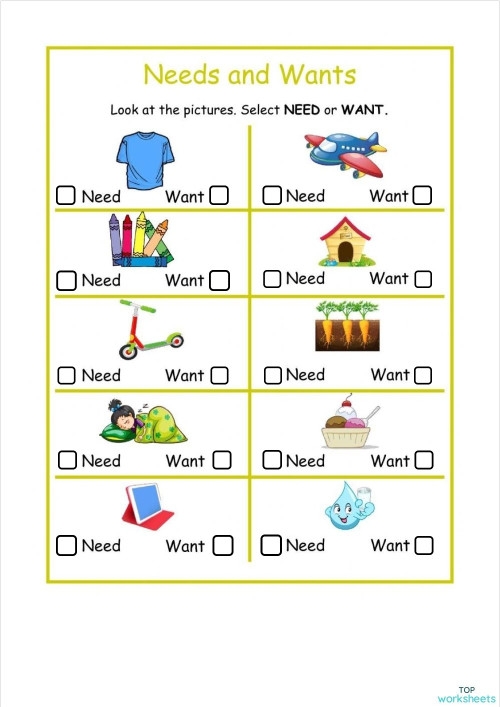

Wants and Needs Worksheet

A wants and needs worksheet is a helpful tool that can assist individuals in identifying and categorizing their desires versus their necessities. This worksheet typically consists of two columns, one for wants and the other for needs. By listing items in each category, individuals can visually see where their priorities lie and make adjustments accordingly.

When filling out a wants and needs worksheet, it is crucial to be honest and realistic about what constitutes a want versus a need. Needs are essential for survival and overall well-being, such as food, shelter, and healthcare. Wants, on the other hand, are items or experiences that bring pleasure or satisfaction but are not vital for our basic needs.

By completing a wants and needs worksheet regularly, individuals can track their spending habits and identify areas where adjustments may be necessary. This can help in creating a budget that aligns with one’s priorities and values, leading to a more fulfilling and balanced lifestyle.

Moreover, understanding the difference between wants and needs can also lead to increased financial literacy and discipline. By making conscious choices about where to allocate resources, individuals can avoid unnecessary debt and save for future goals and emergencies.

In conclusion, a wants and needs worksheet is a valuable tool that can help individuals gain clarity on their priorities and make informed decisions about their spending habits. By regularly assessing and reassessing our wants and needs, we can live more intentionally and achieve greater financial stability and satisfaction in the long term.