When you start a new job, one of the forms you may need to fill out is the W-4 form, which helps your employer determine how much federal income tax to withhold from your paycheck. One important part of the W-4 form is Worksheet A, which helps you calculate your regular withholding allowances.

Worksheet A is used to determine the number of allowances you can claim on your W-4 form. These allowances help adjust your withholding so that you don’t have too much or too little tax taken out of each paycheck. The more allowances you claim, the less tax will be withheld from your paycheck.

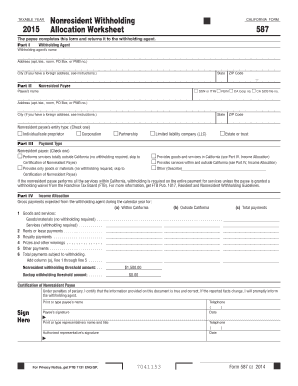

Worksheet A for Regular Withholding Allowances

On Worksheet A, you will need to enter information such as your filing status, number of dependents, and any additional income you expect to receive during the year. Based on this information, you will calculate the total number of allowances you are eligible to claim on your W-4 form.

It’s important to fill out Worksheet A accurately to ensure that the right amount of tax is withheld from your paycheck. If you claim too few allowances, you may end up owing money when you file your tax return. On the other hand, if you claim too many allowances, you may receive a smaller refund or even owe money at tax time.

Keep in mind that you can always update your withholding allowances by submitting a new W-4 form to your employer. If your financial situation changes, such as getting married, having a child, or getting a new job, it’s a good idea to review your withholding allowances to make sure they reflect your current circumstances.

By understanding and properly filling out Worksheet A for regular withholding allowances, you can ensure that your federal income tax withholding is accurate and avoid any surprises come tax time. It’s a simple yet important step in managing your finances and staying on top of your tax obligations.

Take the time to carefully complete Worksheet A and consult with a tax professional if you have any questions or concerns. By doing so, you can make sure that your withholding allowances are set up correctly and that you are in compliance with federal tax laws.